Tbilisi (GBC) - Last December, GBC wrote about the interest of "digital nomads" in Georgia. These high-yield IT specialists are interested in our country because of various advantages. Here, we remind you that the researchers at VisaGuide.World Service published a ranking of the most attractive countries for "digital nomads," in which 38 countries were included - Spain is in first place, Argentina is in second, and Romania is in third place. From the post-Soviet countries, only Estonia (20th place) and Georgia (24th place) were included in the ranking.

Who are these "digital nomads," why did this term become established recently, and why do they choose Georgia - these and many other questions were answered by Shorena Kopaleishvili, who is the chairman of one of the active Association of Georgian Virtual Zone Persons (VZP). For information, the Association unites those international IT companies that entered the Georgian market thanks to tax incentives and creates high-paying jobs.

- What is the "digital nomad" phenomenon, and who are these people? When and why did this trend emerge?

Shorena Kopaleishvili: These are people who travel and work simultaneously (digital nomads). They are high-level professionals who are not required to work from an office. In general, they only require a reliable and high-speed Internet connection to work, but they also pay attention to other circumstances. The majority of these people work with digital technology, allowing them to work remotely. This phenomenon emerged in the early 2000s, and the advent of modern technology has made this lifestyle possible, with the COVID-19 pandemic fueling its popularity even further.

Many people have realized that not only is it possible to work remotely, but many people are more productive when they work remotely. However, there is a difference between digital nomads and remote workers. What separates them from each other is the "factor of traveling". Digital nomads generally travel and change locations, while remote workers generally work from home.

- Georgia is ranked 24th among the 40 most attractive countries for "digital nomads." What other factors, besides the 6-month tax break and low cost of living, entice IT professionals to relocate to Georgia?

Shorena Kopaleishvili: - As previously stated, "digital nomads" are people who travel frequently and relocate to find the best environment and workspace for them. The primary factors influencing these people's decision to live in one jurisdiction rather than another are more or less highlighted. These include visa availability, average internet speed in a given country, tax policy, healthcare system, cost of living in a foreign currency, developed tourism sector, appropriate climate, high level of security, and more.

Georgia is considered a very attractive location for IT specialists; however, for the sake of objectivity, we should note that the reality in some cases differs. For example, Internet speed remains an issue in Georgia, and progress in this area is slow. Also, there is a lack of clear tax navigation for taxpayers. Another recurring theme in recent years has been the banking sector's lack of an accurate and clear compliance policy, which impedes the smooth operation of bank accounts and access to finance. I believe that collaborative efforts in this direction should be activated.

There is already much known about the government's policy with regard to the development and support of the information technology sector, which is encouraging. The introduction of favorable taxation regimes for IT companies, such as Virtual Zone Person status and international company status, has been beneficial to the country. The result of this decision was the entry into the market of both large corporations and numerous startups. As a result, these factors have primarily contributed to the industry's growth and success. According to National Bank data, Georgia generated $231 million in revenue from software development and computer service provision in the first quarter of 2023. This is 322% higher than the result for the same period last year. I guess that the full 12-month figure is even higher and more impressive.

- As for the quality of the Internet, what is the situation in this regard in the country today, and what steps should be taken by the providers to speed up the Internet and equal the speed of developed countries, even Spain, which is the most attractive for "digital nomads"?

Shorena Kopaleishvili: - According to 2023 data, Georgia ranks 24th among attractive countries for "digital nomads." Only Georgia and Estonia were included in this ranking of post-Soviet countries, and our country lags behind the latter, particularly in terms of Internet quality. Georgia's internet speed averages 30 MB/s, which is quite low. However, I believe Georgia has taken significant steps in this direction. In November 2023, Freedom House's annual report on Internet freedom in the world was published, with Georgia receiving 25 points out of 100 and being classified as a "free" country in terms of Internet freedom. The Internet is fully accessible throughout Georgia. According to recent data, 89% of families have access to the Internet.

The main challenge still remains limited market access and the dominance of a few large companies that control the core network infrastructure, reducing competition and the pace of quality growth.

- We mentioned tax benefits. Are these benefits really attractive? For specialists who come individually, these may be favorable benefits, but what happens in this regard to large international companies, which were attracted by the tax benefits allowed for companies in the Virtual Zone?

Shorena Kopaleishvili: - Georgia's preferential taxation regimes were very appealing to many international IT companies and specialists. In this regard, the Virtual Zone achieved one of the highest rankings. Since 2011, more than 1100 companies have received this status. The growth of the segment of companies with VZP status, as well as the entry of new large companies into this sector, would be even more active if there were no gaps/ambiguities in the tax legislation that governs this industry.

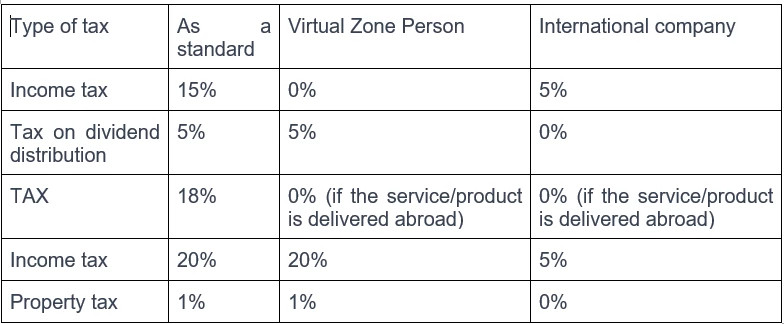

Today, there are two preferential tax regimes for the IT industry:

It should be noted that the tax and special legislation establishes different approaches, conditions, types of activities, obligations, and exceptions for each enterprise category to qualify for the benefit.

- What is the difference between "digital nomads" and Virtual Zone? Which is more effective for the economy of the country?

Shorena Kopaleishvili: - Although we are in contact with the information technology sector and the specialists who work in it, there is a distinction between the two. A company must meet several requirements for Virtual Zone Persons, including employing local personnel and having a material asset, among others. In addition, to be eligible for this status, you must be a resident enterprise in Georgia, not a natural person or an individual entrepreneur. Accordingly, this status for the country brings more positive economic effects in terms of budget taxes, and most importantly, this corporate model is more stable and sustainable in contrast to digital nomads, who, as individuals, may simply not like the country's climate anymore and decide to leave the country.

- What are the plans of your Association for this year to regulate the problems that you talked about above?

Shorena Kopaleishvili: - The Association of Georgian Virtual Zone Persons played an active and, one might say, decisive role in the processes involving the specific IT sector, in particular, VZP status companies. Everyone recalls the tax pressure these companies have faced since the end of 2021, which was primarily caused by flawed and ambiguous legal norms. Companies with this status have had the most difficult years, but we have managed to revise the taxation policy, resulting in the complete removal or significant reduction of taxes, fines, and penalties levied on companies.

We still believe that the main and necessary condition for the development of this sector is to create a legal framework taking into account the best local and international business practices. It is impossible to develop this or that business sector if it does not have solid legal guarantees, a foreseeable tax policy, and a stable business environment.

I think this year will be very productive in this direction, and the stated policy of the government will be reflected in concrete actionable steps. In turn, the Association and business are ready to engage in public-private dialogue to create a healthy and competitive business environment for IT companies to operate in Georgia.