Tbilisi (GBC) - The supervisory capital of the banking sector amounts to 14.02 billion GEL as of April 1.

A new counter-cyclical buffer has been launched for the sector since March.

According to the NBG, banks, including microbanks, are required to have an excess reserve of 0.25%. A digital bank (Paysera, Pave Bank) is exempt from these and other capital regulations.

With the newly implemented buffer, the system will not lack more than $125 million in resources.

The 0.25% is the first phase of the 1% capital requirement distributed over 4 years and will be effective until March 15, 2025.

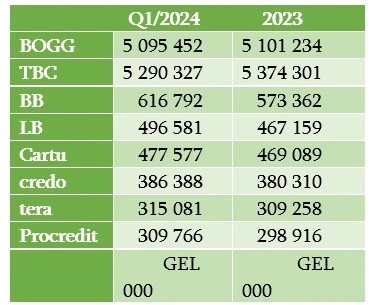

Then it will be doubled and the 0.5% rate will apply until 2026. It will equal 1% on March 15, 2027. TOP 6 Banks with Supervisory Capital.